NLB Group Achieves Record Business Results in 2022

Historical Success

editor

The Adriatic Team

Despite the precarious circumstances, the shadow of war in Europe, the resulting energy crisis, and the economic slowdown, 2022 was the best year in the history of NLB Group, the bank announced.

The Group reached many important business milestones, and through responsible environmental and societal actions once again confirmed its commitment and its contribution to a better quality of life in South-eastern Europe, which they call their home region.

»These actions for example include both our commitment and adoption of policies, such as United Nations Net Zero Banking Alliance or NLB Group Net Zero Strategy, as well as tangible actions of our banking members and our employees, for instance offering new sustainable products, reducing paper consumption thereby saving 866 trees or planting more than 6000 new trees throughout the region. We are proud that our efforts and our progress in the field of sustainability were confirmed by our first ESG rating – Sustainalytics rated NLB with an ESG Risk Rating of 17.7 and a low risk of experiencing material financial impacts from ESG factors,« the bank explained at the media event held at the of February.

In 2022, NLB Group’s result after tax amounted to EUR 446.9 million, with the acquisition of N Banka in March significantly influencing the full-year business results of the Group. Excluding the total contribution from N Banka, net profit grew by 11% and reached EUR 262.8 million. We ended the year with a strong capital position, as the total capital ratio of 19.2% gives us confidence and optionalities to pursue future growth ambitions. We will continue to create added value for our shareholders, live up to expectations of our clients, employees, and the public, as well as seize all opportunities in front of us.

Highest profit in history

»While the past year has been extremely turbulent for Europe, it presented yet another opportunity for banks in NLB Group to prove their systemically important role in society,« emphasized NLB’s CEO Blaž Brodnjak as the unaudited 2022 results were published.

He explained: »Following the uncertainties, challenges, and consequences brought on by the war in Ukraine, all our member banks have contributed their share to the stabilisation of the banking industry and regional economy. Later on, the Group’s banks in various markets also stepped up in times of the instability of the energy sectors and by providing much-needed liquidity contributed to the successful mastering of this challenge, as well. All this came on top of the Group’s regular business objectives of growth in all key segments. It is therefore not without pride that we emphasize: in 2022, NLB has generated the highest profit after tax in history of any Slovenia-based business.«

New Opportunities for growth

The Supervisory Board is also pleased with the performance of NLB Group in the past year, with its Chairman Primož Karpe highlighting new opportunities for creating added value the Group addressed in 2022. »We estimate that, on the one hand, new opportunities for growth come from additional leveraging of synergies within the group on the back of an increased investments into digitalisation, and on the other hand by the expansion of certain activities. An example of the first is the NLB DigIT competence centre the Group established in Belgrade in order to keep and build on its digital leadership position in the region; and an example of the second is an expansion of leasing activities to two additional markets,« he explained.

»Such business decisions are made strategically and based on a strict adherence to the principles of risk and profitability, all with the aim of creating additional value for stakeholders,« Karpe added.

Sustainability: Leading by Example

Interview: Andrej Lasič

editor

Maja Dragovic

JOURNALIST

With almost 3 million customers, NLB Group is the leading banking group in the Southeast Europe region. The current geopolitical tensions and rising prices have an impact on its operations in the region, but the Group is well prepared for a possible deterioration of the business environment, says Andrej Lasič, a member of the NLB Management Board (CMO) responsible for Corporate and Investment Banking, who has been with the NLB for 10 years.

High energy prices are impacting the competitiveness of European companies, with many expecting a decrease in the demand for their products next year. How do you view the current state of the economy in Slovenia?

Though it is true that uncertainties are increasing due to inflation and rising energy prices, the state of the Slovenian economy is actually very good. This is evident in the very, very low unemployment numbers. Companies are still looking for a quality workforce which will continue to be very important. Productivity and profitability also remain high, and order books are full, which means that business operations will be stable for some time. The Slovenian economy is also one of the most diversified economies in Europe, since we do not depend on a single industry or a single market. Shocks are therefore easier to withstand compared to the economies that depend on individual industries.

Another evidence of the stable state of the economy is a record low indebtedness. At the end of November, Slovenian companies had approximately EUR 11,6 billion in loans, which represents 20% of GDP and is by far the lowest in Europe, where the average is 40% of GDP. For comparison: when entering the crisis in 2008, Slovenian companies had EUR 20 billion in loans, which was almost 60% of GDP at the time. The companies are therefore in good financial condition, with liquidity and low indebtedness, while at the same time the banks are also highly liquid and well capitalized.

All this are good predictions for the times to come, even though economists are aware that the growth of the past nine years cannot only go upwards indefinitely. There will be a certain correction, but the question is how severe it will be and how we will endure it. As said, compared to other EU countries, we are very well prepared. With a comprehensive and consistent policy that adequately supports all affected segments, and with the cooperation of all stakeholders in society, Slovenia can be among the winners. To illustrate I usually like to refer to the famous quote of Ayrton Senna said: ‘You can’t overtake 15 cars in the sun, but you can in the rain.’ The rainy times are definitely coming, however, the challenges also bring opportunities. We are convinced that our home SEE region has enormous potential in various areas, from infrastructure and logistics to the green transition.

How severe do you expect the crisis to be?

Perhaps it is a fortune in a misfortune that Slovenia and the SEE region are more used to the inflation than the countries in the Western Europe, where inflation has not been an issue for 70 years. Nevertheless, the rise in prices, especially of basic raw materials, is already causing a drop in purchasing power and, to a certain extent, the demand. The current crisis is most dangerous for labour-intensive industries and industries with relatively low added value and low profitability. But crisis would be worse if there was no supply of energy products, which would lead to a reduction or even halt of production in many places. With these inflationary shocks, I would advise companies to take care of working capital and liquidity.

On the other hand, common sense is returning: every new investment and new development will have to be carefully considered to mitigate short-term, especially supplier liquidity shocks in the entire economy. At NLB, we advocate long-term partnership, so I advise companies to come to us in time so that we can discuss their situation and ensure sufficient liquidity for the upcoming uncertain and challenging period.

How is NLB Group affected by the current economic conditions in the region?

All the countries in the region are recording solid economic growth and for the time being we are not seeing any major upheavals. It is also a good sign that all the countries are gradually integrating towards the European Union. The strength of individual countries will be reflected in how they react to the anomalies that are occurring, for example with a cap on energy prices. Our banks in the region are focused mainly on loans to residents and small and medium-sized companies, the span here is large, so we do not anticipate any major problems. These economies are not heavily involved in global trade which further mitigates their exposure to shocks.

As it stands at the moment, the hike in energy prices in 2023 will be ten-fold. How can the banks help companies weather the storm?

Banks can most definitely help. Precisely in connection with the energy crisis has NLB, for example, already played an important, systemic role. The government namely addressed the issue and helped the electricity segment survive the ups and downs of energy prices with systemic laws, NLB, however, was the one that organized all syndicated loans for this segment and provided it with the necessary liquidity so that Slovenia could obtain sufficient amounts of energy. From Ljubljana, we have also organized similar solutions for Montenegro, which had major problems with supply due to low water levels, and also for Serbia.

And now if we focus solely on companies: Slovenian companies have a robust cash flow, but their key challenge at this time is definitely the energy price. However, there have been some positive developments. At long last, we have seen the longawaited measures of the European Commission. The agreement of the EU members on the mechanism for limiting gas stock market prices has caused gas and electricity prices to fall considerably, and with this the offers for supplying Slovenian companies with electricity also fell. This is, for now, good news. If the prices are too high, then no economy will be able to sustain them. In this case companies would opt for extreme measures such as limiting and closing production, because they would not be able to cope with such energy costs.

So how can the bank help? On average, Slovenian economy has little debt, and our banks are extremely liquid and capital adequate. Taking care of working capital is key in companies, also due to rising energy costs, to ensure they have enough liquidity to weather any shocks. We will certainly help them with this. Companies must change their short-term business plan, especially the liquidity plan for the next few months. It is also necessary to prepare for the worst case scenario, define the extent to which the profitability of production survives and secure liquidity in time.

The change in business strategy due to the energy component will certainly be used by some companies for a simultaneous sustainable transformation. This is the right direction, which we enthusiastically encourage and support, as well as live by ourselves. In recent years, NLB and the NLB Group have focused intensively on integrating sustainability into our daily operations and promoting the transition to a low-carbon economy both in Slovenia and in the entire Southeast Europe region where we operate.

Could you explain in what way is NLB Group integrating sustainability in its own business?

True, in the NLB Group we have put sustainability of our decisions and actions at the heart of our business, and we are truly dedicated to these topics. What I would like to stress out in the beginning though is that contrary to the all-too-common misconception, sustainability doesn’t only include environmental (let’s say “green”) issues, but also equally important social and governmental components. In the NLB Group therefore, we are addressing all of them.

We have, for example, established the NLB Group Sustainability framework and upgraded our management of climate and environmental risks. As the first bank from Slovenia, we have committed ourselves to the UN Principles for Responsible Banking, and joined the United Nations Net Zero Banking Alliance.

We address the green strategy everywhere: we have consciously decided not to finance coal energy (this is mostly an issue in Serbia and Bosnia and Herzegovina), we are also intensely co-operating Alfi Green fund to finance green projects in our home region. We are introducing new sustainable products, such as the so-called green loans for corporate investments in the energy efficiency of commercial buildings and the reduction of the carbon footprint. Together with the EBRD and Erste, we have financed the wind farm project in Kosovo, which is already in operation and can supply more than 100,000 households with electricity, i.e. up to 10% of Kosovo’s consumption. Shortly, another similar project will be concluded in Serbia. In addition to financial support, we also have a great deal of knowledge and experience with which we can contribute to a company’s easier and smoother sustainable transition. Of course, we also take care of our own carbon footprint.

And how does this translate in concrete steps?

There are almost too many of them to list, but we can, perhaps, illustrate our efforts with our own, internal measures. For example: for almost 3 years now, NLB employees have had the option of a hybrid way of working, if the work process allows them to do so. It is a combination of working from home and working in the office (4 days: 1 day). This option is well received, so that well over 700 employees are already working in this way. This, on the one hand, significantly improves the quality of life of our employees, contributes to reducing the burden on the environment, and also reduces the need for office space. So, in a few years we will be able to transfer our headquarters from the current building which was built in the 1970s and is, from the energy point of view, vastly inefficient to premises outside the strict city center which will be green and self-sufficient.

We are very successful and actively supporting our customers in the region to learn how to use digitalised services so visiting branches will no longer be necessary. Less branches will significantly reduce the carbon footprint.

All our efforts have already yielded recognition. We are very proud that NLB received its first ESG (Environmental, Social and Governance) rating in December last year by Sustainalytics, one of the world’s leading independent ESG research, ratings and data firms. The ESG Risk Rating places NLB among the best 15% banks assessed by the company and we are the first bank with headquarters and an exclusive strategic interest in Southeast Europe which has obtained this rating.

You are focusing on supporting green projects in a region that still heavily relies on coal for energy production. How can this coal reliance be reversed?

This is not the case for the whole region. Croatia has made big strides in transforming its energy production and consumption. There is also a huge opportunity for Slovenia and Croatia to find a common solution for nuclear energy (as transitional energy) because there is already joint ownership of the Krško nuclear plant. Montenegro is also relatively self-sufficient and its energy production is approximately half green and half thermal.

The countries with the most challenges in this field (and, on the other hand, also the most opportunities) are Bosnia and Herzegovina, Serbia and North Macedonia. In BiH, all energy production comes entirely from coal, hence why its cities are the most polluted in the world and one of the reasons why its inhabitants are leaving the country.

NLB Group generated EUR 377.8 million of profit after tax in the first nine months in 2022, a substantial increase compared to the same period in 2021 when the profit amounted to EUR 205.5 million.

But the problem is exasperated further because BiH doesn’t have the resources or access to financial markets to deal with the problem itself and this is where I believe the European Union has to step in and put together a comprehensive development plan or strategy for the region. It namely needs to invest in energy infrastructure to clean up the air. Furthermore, the region is also in dire need of investments in other infrastructure, especially roads and railways. Getting from Ljubljana to Sarajevo, Skopje or Podgorica is currently mission impossible and these key cities need to be connected. These are all common sense, but highly demanding and important measures that need to be taken in the region as soon as possible in order to enhance the quality of life, which is paramount if we wish to keep young people and talents. In the NLB Group, we are strongly advocating all of this and supporting these incentives with everything that is at our disposal. Last but not least, this is our home and we want to see it thrive.

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.

Utilizing the Power of Data

Force for change

editor

Barbara Matijašič

JOURNALIST AT THE ADRIATIC

Secondary use of data and digital transformation: how the healthcare, insurance and banking sectors can profit from each other’s data.

To facilitate a successful digital transformation, it is crucial to have strong leadership and clear objectives, adequate funding and resources, an effective implementation strategy – and last, but not least, relevant and informative data. There’s an old saying, ‘Garbage in, garbage out’, which means that if you input senseless or defective data, you’re going to get a meaningless output. Digital transformation should be tailored to meet the specific needs of every individual and geared to adhere to the laws of the country. And this is where the use of secondary data comes in – it is the process of collecting and analyzing aggregated and anonymous data that has been previously collected for a different purpose, but whose output can provide beneficial insights into behavior, trends and patterns that can be used to update and enhance digital transformation initiatives without compromising the trust and safety of personal data. This can provide many useful and innovative solutions in all sectors. This article aims to highlight the value and benefits from the transfer of learning between the healthcare, insurance, and banking sectors. They can learn from each other’s experience, as they often face similar obstacles in the context of secondary use of data and digital transformation.

Exchange of knowledge and resources

Cross-sectoral collaboration happens when two or more organizations from different sectors come together to work on a specific project or initiative; it involves an exchange of knowledge and resources between entities in different industries. The main pillars of a successful relationship are mutual understanding, trust, and commitment, in addition to having good communication, shared goals, and a mutual understanding of the benefits of working together. Each partner also needs to be open minded with regards to learning, adapting, and being innovative in order to take full advantage of the different mindset and expertise of the other entity.

This open-minded approach allows both partners to gain new insights, develop innovative solutions to complex problems and discover new ways to leverage resources. A recognized and very well-used example of cross-sectoral collaboration involving the health, banking, and insurance sectors is the development of healthcare payment models. In this type of collaboration, banks, insurers, and healthcare providers work together to develop payment models that are more efficient, transparent, and cost-effective. This collaboration enables healthcare providers to receive payments more quickly, reduces paperwork and administrative costs and improves the financial health of both providers and patients.

When contemplating the secondary use of data and digital transformation, the sensitive question of trust alongside the increased security risk are among the top concerns. However, issues of trust can be overcome by implementing stringent controls that ensure the security and privacy of data, making sure that the data is encrypted and stored securely, as well as the use of user authentication protocols to verify the identity of users. Organizations should also have policies and procedures in place that restrict access to data to those fully authorized.

Finally, organizations should regularly monitor and audit access to data to ensure that it is being used appropriately. A good example of overcoming trust issues between users is in the insurance sector, for example, the insurer within most insurance organizations can easily access a clear and comprehensive privacy policy that outlines the manner in which customer data is stored, used and shared. The process of making changes to the policy and communicating them to their customers is clear and transparent. Insurance organizations also provide detailed information about their services and ensure that customer queries are answered quickly and accurately through online self-service portals. These portals also enable customers to access their policy information and manage their policy online, such as viewing their policy details, paying their premium, filing a claim, and making changes to their policy. On the other hand, security risks in the banking business are addressed using multifactor authentication systems. Users are required to provide more than one type of authentication, for example, use of passwords, biometric scans or SMS codes, to access their accounts. This makes it more difficult for hackers to gain access to sensitive information, and thus protects both the bank and its customers.

Technical solutions are not difficult to find, however the real question is how to motivate people?

So one may ask why the two aforementioned examples of effective working practices in banking and insurance can’t be transferred in a meaningful way to the field of healthcare? The field of healthcare in Slovenia and in the countries of the Western Balkans is one of the more complex sectors, as it connects stakeholders from many different fields, namely, politics, pharmaceuticals, public and private institutes as well as product and service providers. However, the optimization and development of health systems is necessary – especially with regards to the management of the limited resources available to meet the needs of an aging population. Slovenia is one of the EU Member States that is anticipated to have one of the largest increases in social expenditure and health services related to the aging population by the year 2060. However, many of these challenges can be solved using open and trustworthy health data systems. The anonymized data can be used to identify phenomena and trends, as well as aiding the development of the healthcare system through various analytical approaches and the combination of data into meaningful data sets.

Interoperability of data and services is crucial. It supplies a secure exchange of data between different providers and systems, as well as sectors, and leads to efficient digital transformation. The Minister of Digital Transformation, Emilija Stojmenova Duh, stated that digital transformation will be one of the key priorities of the Slovenian government in the coming year. Motivating people to engage is a long-term commitment, ensuring that each partner understands the benefits and has an open mind with regards to adaptation and innovation. However, the anticipated challenges of an aging society and the problems facing the healthcare system cannot wait. They are already here, we must face them and find innovative solutions, and secondary use of data and digital transformation is the way ahead.

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.

New Slovenian Investments in Montenegro Create More Opportunities for Europe

Slovenian-Montenegrin business forum of economic cooperation

editor

The Adriatic Team

On February 21, 2023, the Institute for Strategic Solutions, the Public agency Spirit Slovenia, the Slovenian Embassy in Montenegro, the Slovenian Business Club in Montenegro, and the Chamber of Commerce of Montenegro organized a Slovenian-Montenegro business forum to discuss economic cooperation between the two countries. The event was held at the Hilton Hotel in Podgorica, and it was titled "Economically connected, regionally stronger". The focus of the discussion was on the economic integration of the Western Balkans and the benefits of cooperation between the two countries. The interlocutors agreed that there is still ample room for cooperation between companies, especially SMEs. Montenegro needs to strengthen cyber security and resistance to cybercrime, as well as promote a dual system of education, which is essential for long-term development.

Following the event, the participants had a working lunch with the President of Montenegro, Milo Đukanović, to discuss economic cooperation between Slovenia and Montenegro.

Gregor Presker, the ambassador of the Republic of Slovenia in Montenegro, stated that about 150 Slovenian companies are actively operating in Montenegro. He also highlighted the opportunities available for Slovenian companies in the IT industry, the environment, and food cultivation and production. The development of a business-friendly environment in Montenegro requires independence of the judiciary, continued efforts to fight corruption, and the elimination of administrative obstacles. There are also increasing numbers of Montenegrin investments in Slovenia, which is encouraging, said Presker.

Tine Kračun, the director of the Institute for Strategic Solutions, emphasized the importance of the intertwined cooperation between Montenegro and Slovenia, which is Montenegro’s fifth-largest economic partner. He stressed the need for developing a model in which supply chains will be fast, efficient, and of high quality. This would bring global competitiveness and visibility to both countries.

Dr. Nina Drakić, President of the Chamber of Commerce of Montenegro, highlighted the importance of further developing the IT industry, waste management, and natural resource investment for Montenegro’s economic growth. She suggested that Montenegrin tourism could benefit from experiences in Slovenia’s continued development.

Dr. Olivera Blagojević Popović, acting Director General of the Directorate for Investments and Development of Competitiveness in Tourism, which operates within the framework of the Ministry of Economic Development and Tourism of Montenegro, presented a more detailed overview of tourism projects. She stated that Montenegro is one of the fastest-growing tourist destinations in the world, and the business environment is friendly for investors. Some of the most important projects in recent years include Portonovi, which is financed by Azerbaijani capital and is unique in several aspects, and the Luštica Bay tourist complex, which is being developed by Swiss capital. Mamula Island is also designed as a unique hotel with a with a museum-like ambiance. She said that Montenegro’s tourist infrastructure is developing significantly, with the construction of the almost four-kilometer Kotor-Lovčen cable car, which will be able to transport 1,200 passengers per hour.

Cyber security among the most important measures

The panel included lectures on security and trust. Roland Žel, director-general of the Directorate for Defense Policy at the Ministry of Defense of the Republic of Slovenia, emphasized Slovenia’s strategic interest in peace, stability, and prosperity in the Western Balkans. He highlighted Montenegro’s path to NATO as an example of Slovenia’s cooperation and support for the country of Montenegro. He explained that Slovenia is strategically supporting Montenegro in its involvement in international activities that contribute to this, also at the level between the two countries.

Gorazd Čibej, director of the Insurance Supervision Agency, also touched on the importance of cyber security, especially for financial institutions and insurance companies, especially in the light of protection against cyber risks and attacks. “Insurance companies are the fifth most exposed target of cyber attacks in the world. Financial institutions must do their best to protect customer and business data,” emphasized Čibej and listed examples of good preventive practices implemented by the agency as the Slovenian regulator of insurance companies in the supervision of insurance companies, including regular quarterly monitoring of cyber risks at insurance companies.

Space for medium-sized companies

Representatives from various fields including development institutions, banks, insurance companies, and entrepreneurship, gathered at a round table to discuss economic integration and cooperation in the Western Balkans. Irena Radović, the executive director of the Investment and Development Fund of Montenegro, mentioned that part of the fund’s activities includes cooperation with the Slovenian government, specifically in the area of reducing drinking water losses in Podgorica. She also revealed that Montenegro has EUR 9 billion available for similar projects. Radović further emphasized that every Slovenian investment creates opportunities for new Slovenian and European investments in Montenegro.

Marko Čelebić, director of the Department of Business with Legal Entities and executive assistant to a member of the board of NLB in Podgorica, highlighted the quality of the Slovenian economy, which is diversified and developed, and therefore can significantly aid Montenegro’s economy. However, Čelebić assessed that there is still ample room for medium-sized companies to invest in Montenegro.

Matjaž Božič, executive director of the insurance company Lovčen osiguranje, presented data indicating that the average insurance premium in Montenegro is 160 euros, equivalent to 2% of GDP. He stated that insurance products and knowledge are developed and available to local companies in Montenegro, but communication with customers and establishing trust remains a significant challenge that needs addressing.

Blagota Baća Radović, owner of the construction company Zetagradnje, which also operates in the Slovenian construction market, compared the business environment in Montenegro and Slovenia and pointed out a factor that hinders Montenegrin development. He stressed that while the legislative framework is good, some infrastructure solutions, such as sewage and electricity, cannot be implemented quickly enough, and the state must play a role in addressing this. Radović also mentioned the need to strengthen Montenegro’s energy self-sufficiency through solar energy production, urging cooperation with Slovenian companies to preserve their land and nature.

Balša Ćulafić, coordinator for cooperation with international chambers at the Chamber of Commerce of Montenegro and national coordinator of the investment fund of chambers for the Western Balkans, expressed concerns about the lack of dual education programs in Montenegro, believing that it hinders long-term successful development.

All of Us Are Responsible for Ensuring a More Sustainable Tomorrow

Securing the Future

editor

In Cooperation with Triglav Group

Under the umbrella of the Securing the Future project, the Triglav Group are stepping up their efforts to help create a sustainable future.

Since the launch of the project in 2022, each month has been dedicated to promoting and achieving one of the 17 UN Sustainable Development Goals and, in collaboration with more than 200 partners in the fields of sport, culture, health, prevention and business, to encouraging the general public to act sustainably. “The main message of the project is that we are all responsible for securing a more sustainable, green and just future, and that each of us can do something to make a difference today. There is no need to wait for tomorrow,” said Nina Kelemen, head of sustainable business at the Triglav Group.

Changing the World Through Concrete Action

Triglav is committed to sustainable development in four key areas: insurance and asset management, business processes, a responsible approach to stakeholders and effective corporate governance. With campaigns such as For a Better Tomorrow, Let’s Clean Up Our Mountains, Children of Triglav, Young Hopes, the Triglav Run,Young Hopes and Driving Refresher, as well as the Vozimse.si platform and many other projects, the Group are already taking decisive steps towards a better future. With a commitment to sustainable development, they are also creating a stable long-term basis for safe and secure business operations.

“We are promoting digital business, strengthening an awareness of sustainability among our employees, carrying out comprehensive measurements of our carbon footprint, and focusing hard on the energy renovation of our buildings. Our portfolio already includes insurance for claims arising from damage caused by climate change, as well as solar power and micro-mobility insurance. As far as managing our own portfolios is concerned, we are increasing the share of sustainable and green investment classes aimed at financing the green transition. By carrying out systematic measurements, we are able to ensure high levels of customer satisfaction, develop our employees’ expertise and competence, implement effective health promotion programmes, and promote multidimensional diversity and intergenerational cooperation,” says Kelemen. In the future they intend to strengthen and restrengthen their contribution to a sustainable, just and green future through a variety of activities and awareness-raising efforts.

Your Promise for a Better Tomorrow

More than 200 partners who have joined the Let’s Secure the Future (Zavarujmo prihodnost) project have already accepted the challenge to become part of the #Zavarujmoprihodnost community. Everyone can commit to at least one activity for each of the 17 Sustainable Development Goals – one that is close to their heart and that will help them contribute to a sustainable future.

Together with the Disabled Sports Federation of Slovenia (Paralympic Committee), which promotes innovation and the development of (technological) solutions to make involvement in sporting activities easier, the Triglav Group are raising awareness of UN Sustainable Development Goal 9 (Infrastructure, Industrialisation and Innovation) throughout the month of February. Top paracyclist Anej Doplihar reminds us in this video of the importance of providing comprehensive infrastructure and of the need to foster innovation to ensure a better quality of life, greater freedom and more equal integration into in society.

To help and inspire people to find activities that enable everyone to pitch in and play their part in the sustainable transformation process, the www.zavarujmoprihodnost.si website will offer fresh ideas for things we can do as individuals and organisations and that help us to inspire each other, whether it’s cycling instead of driving to work, using digital business approaches, helping out at a local animal shelter or volunteering at a retirement home. #Zavarujmoprihodnost.

Triglav Welcomes the Digitally Talented

Digitalization

editor

IN COOPERATION WITH THE TRIGLAV GROUP

Triglav’s customers are getting more and more excited about their new digital insurance services. This is a great achievement for Triglav’s teams of digital experts who teams consist of the most highly sought after IT people on the labour market. The recruitment team at the Triglav Group have listened to the goals and expectations of the high calibre staff and have managed to attract many of them to Triglav through understanding and meeting their needs, as well as through Triglav’s excellent reputation as a reliable, secure and flexible employer.

Digital experts are a vital part of the Triglav Group’s key business areas, with their combined knowledge and competences in insurance and IT. In order to excel in the digital environment, Triglav need to attract highly skilled staff, the crème de la crème, and that is a significant challenge! Therefore, a focused and targeted approach to the recruitment of digital talent is very important. At Triglav, they have analysed what high calibre employees are looking for in terms of salary, and what they want to achieve once they are hired.

“Judging by some of the interviews we’ve done recently, the introduction of the option to work from home was the biggest step we’ve taken towards meeting the needs of new talent, and this is often their first question. Employer reliability and job security as well as good work and employment conditions are also key requirements.Many candidates come from smaller companies where they are often troubleshooters and all rounders, so many applicants really appreciate the opportunity for the focused professional development and training that we can offer them at Triglav.” says Alenka Bešter, Director of Digital Marketing and Content Management at Zavarovalnica Triglav, highlighting some of the advantages of working for the Triglav Group.

Her recruitment strategy is confirmed by Triglav’s staff and their achievements. Perspective, financial stability and Triglav’s success were among the reasons why Lucija Vermezović, Specialised Sales Channel Coordinator, decided to join Triglav Osiguranje, Belgrade. She says that job security, respect for traditional values and a focus on personal development, all in accordance with European Union standards are her most important criteria for joining a company. The outstanding business performance of the Triglav Group also convinced Mark Prelec, Digital Business and Customer Experience Associate at the Zavarovalnica Triglav, to join the company. The opportunity to co-create the digital future of the largest insurance company in the Adria region was the main reason that he chose to join Triglav.

Triglav want to stay ahead of the curve by taking a more focused and strategic approach to recruitment while also developing their employees to their full potential by providing them with the right opportunities to develop and progress their career. The Triglav Group offers employees a large number of benefits including the use of the most modern technology, flexible options to work from home, a creative and dynamic working environment, stability, and a highly reputable, family-friendly company with a good work- life balance, as well as on the job mentoring, continued professional education, and a great experience.

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.

In Family Businesses, Financing is still the Key Concern

Family-run companies

editor

Nina Novak

JOURNALIST

There are brave business people everywhere in SE Europe - visionaries motivated by brilliant ideas and equipped with a business plan and the willpower and drive to turn an idea into reality. These people may prove to be the business founders or the leaders of a family venture.

One of the best ways to promote economic growth in a region where family-run businesses account for approximately 50-60% of GDP is for financial institutions to work with them. Financing operations in family businesses can be assessed by three key criteria: control of cash flow, liquidity and having sufficient capital reserves, say experts at NLB. The driving forces behind financing decisions in family businesses tend to be based on personal preferences regarding the rate of business growth, attitude to risk and the ownership structure. The most common forms of financing in family businesses are from the retained profits of previous years and bank loans. All successful companies have the same merits, namely, high-quality products and services, strong control of operating costs, adaptable and focused management teams, a known presence in international markets, and strong and durable supply chains.

Two of the key challenges faced by family businesses are the harmonisation of interests between the different generations and the creation of clear boundaries between business and family activities, they emphasize in NLB. Family-run businesses play an important role in employment creation and economic development, so they can rightly lean on regional banks for assistance when overcoming unexpected challenges. The consultation process in the selected bank should review all aspects of the business thoroughly as well as the associated risks. It is crucial to understand the company’s business model, how and in what manner the companies generate revenue, what their relationships with customers and suppliers are like and what are the key responsibilities of the management team and other principal employees. It is also essential that individuals in the company have clear job descriptions and candidate profiles. It is extremely important for the bank that family-run companies know and understand how to deal with the consequences of changing business relationships especially when there is new management and /or new stakeholders. Only when the business model of these companies and the family’s relationship with the company is fully understood can the right solutions be found.

Finding the right partner

It is vital for the family-run company to work with a bank whose portfolio also consists of small and medium sized family-owned businesses, as this ensures that the bank has a broad overview of many different practices and business models in such SMEs. As a result, the bank will have gained exposure to different scenarios and consequently different solutions. NLB, the largest banking group in SE Europe, points out the example of a family business that, through the handover of two generations encountered many challenges and addressed them very precisely in the so-called “Family Constitution”. Family Constitution is a document, written to clearly define all unwanted or prohibited behaviour, for example, the interference of spouses in the business. It also defines the job roles of all the family members employed in the company, outlines their responsibilities, and also identifies their successors. Such a document also defines various risk scenarios and the level of risk permitted under the family constitution. “The family constitution was drawn up in a very thoughtful and precise manner, which subsequently paid off handsomely for the company through the handover between generations, as it helped it navigate successfully through disagreements and conflicts between the heirs and their partners. Such a structured approach to the continued management of the company also benefits the bank during the handover between generations. It helps to answer the key questions that we ask ourselves when deciding whether to cooperate or deepen cooperation with such companies. On such a basis, the bank can also make decisions more easily and manage risks effectively,” they say at NLB.

Almost 40% of family businesses in Slovenia are run by managers who are over 50 years old.

Future challenges family-run businesses can't ignore

Family businesses in the region significantly contribute to the GDP. As with other prosperous companies, the winners are those who are successful in finding, recruiting and retaining talent, companies that continuously maintain a high level of innovation and companies that will adapt their operations to comply with ESG standards. The winners will be family businesses that can successfully implement smooth management handover between the generations, as well as those that generate revenue on the domestic and international markets, they point out in NLB.

Generational change will always be the biggest challenge in such companies. For example, almost 40% of family businesses in Slovenia are run by managers who are over 50 years old. Most of these managers represent the first generation of the family, and they have responsibility for managing and developing these companies. For long-term survival and success, family businesses in the region will have to find an appropriate balance between traditional orientation and innovative development, which means that they will have to accelerate digitalization and also comply with the transition to sustainable operations and the introduction of ESG standards, both of which will be increasingly important in the future.

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.

The Future of Mobility is changing our Mindset

Transformative mobility solutions

editor

Mateja Edelbaher

JOURNALIST

The future of mobility is being fueled by three key technology-driven trends: electrification of vehicles, connected & autonomous vehicles and mobility as a service.

Also, according to research by the EU Commission and other institutions, the cost of owning a personal vehicle i.e total cost of ownership will rise in the coming years, which will mean that many people will have to resort to other modes of transport/mobility. How will mobility affect our everyday lives?

In the cities, we will see a boom in different types of transport. We can already see all types of vehicles on the streets, changes are already happening. Just look at the larger cities, where the infrastructure includes: a bike rental system, e-bike rentals, various electric car sharing, privately owned electric-scooters and electricscooter rental systems, many different modes of food delivery, public buses, trams etc. In cities, people will be able to live without their own personal vehicle, and it is expected that within a decade we will already notice the influence of shared self driving vehicles, which will change our habits and needs. The biggest question we face and which could have a strong impact is the development or quality of public infrastructure (railway, bus) in the future.

We asked the biggest energy company in the Adriatic region, Petrol, how they see the future of mobility and they said that they are already implementing their strategy to meet the future needs of mobility and sustainability. For example, at the Kozina motorway location, they carried out a pilot project of installing an electricity storage tank with a capacity of 210 kWh and they also connected fast and two ultrafast charging stations up to 350 kW.

They also implemented a pilot project of the first local self-sufficient community in Slovenia in the small settlement Luče. In the long term, Petrol will also change its sales points. The plan is for multi-story buildings, and at least one for RES (renewable energy sources) as well as electricity storage, with a larger charging park for electric vehicles and other alternative sources of energy, such as hydrogen.

Jože Bajuk, a member of the Petrol executive board, points out that:

“The development of the market for petroleum fuels in the field of mobility will retain an important role in the next ten-year period; however, electricity will complement it to a greater extent than before. This is also indicated in the guidelines of the most important manufacturers in the automotive industry.” He also explains how they plan to accommodate the change in e-mobility and transport: “Because in the coming years we expect accelerated electrification of road transport and an increase in its efficiency, at Petrol, in accordance with our strategy, we are building a network of charging stations throughout Slovenia and in the region and connecting with the growing network of e-charging stations across Europe. Because the biggest increase in the market share of the electric drive will be in personal transport, while in the transport of cargo and people in larger vehicles, electricity will still be in second position for quite some time.”

Petrol has a total of 318 petrol stations in Slovenia and 574 e- charging stations, which are not located only at petrol stations. They have over 590 locations in the Adriatic region and by 2025 they aim to have 1,575 echarging stations under management in the region. Last year, the first DC charging station was opened in Belgrade, as well as one in Montenegro.

“The electric car market is growing significantly faster than was predicted a year or two ago.”

E-mobility is transforming the auto industry

One of the most important challenges for the automotive industry is its transition to e-mobility. Estimates suggest that by 2030, the proportion of electric cars will grow to 25 or 30 per cent of the market share, which is a fact that global car manufacturers are already adapting to.

“The electric car market is growing significantly faster than was predicted a year or two ago. The slogan of one of our biggest partners describes this trend most eloquently. If MercedesBenz had the slogan ‘electric first’ until last September, it now has ‘electric only’. Car manufacturers no longer invest in the development of the classic drivetrain, but merely adapt it to meet future EURO 7 emission standards. Their strategy is e-mobility,” says Andrej Megušar, CEO at LTH Castings, one of Mercedes-Benz’s development partners based in Slovenia. It also has production facilities in Croatia and North Macedonia.

An electric car has fewer components than a classic car. For example, a gear box is not needed in an average electric car, because the electric drivetrain works equally well in a very wide range of revolutions, with immediate effect from standstill to acceleration – and therefore not even a clutch is needed. The term ‘one pedal driving’ has also become established, which means that some electric cars, such as the BMW i3, can only be driven by pressing and releasing the gas pedal. All this has also been taken into account by LTH Castings, a partner of BMW, which has been producing parts for most of their powertrains for more than 30 years. In recent years, however, cooperation has been expanding mainly into the development and production of components for e-mobility.

The fact that there is no need for parts such as the clutch, which are among the more expensive parts of a classic car, represents a new approach to the development and production of parts by manufacturers, parts such as battery cases and powertrains, and components for the conversion of electrical energy. “Changes don’t happen overnight. We follow developments in technology and reckon that electrification will largely flow through hybridization – mainly due to objective capacity limitations, both in the infrastructure for the use of electric cars and in production. There is no longer any debate about the electric car coming, it is here. The key is how the roles will be divided in the production chain since new typical pieces appear with the electric car. There are quite a few of them, and to a considerable extent they are pressure castings, which is good news for LTH Castings,” says Igor Grilc, CEO at LTH Castings.

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.

Let's think Enterprise. Let's work Sustainable

Sustainable finance

editor

Špela Bizjak

JOURNALIST AT THE ADRIATIC

NLB is convinced that the future belongs to those who operate sustainably.

At NLB’s traditional regional business events in Slovenia, NLB encouraged people to embark on the path of sustainable development and to adopt a caring and responsible attitude towards the environment and society. The events were dedicated to current conditions and the realization of a sustainable future. One of most important questions was how to deal with new challenges and opportunities for the sustainable transformation of the company.

Blaž Brodnjak, President of the Management Board is convinced that responsibility does not start with companies, but with each individual. “Until we change our habits, we cannot talk about change. We need focus, a clear vision and clearly defined priorities, but everyone has to start with themselves and apply sustainability principles in their everyday life”, Brodnjak added.

Orientation towards the future

Dr Vasja Rant, associate Professor of Money and Finance at the School of Economics and Business in Ljubljana believes that orientation towards sustainability is the direction of the future. Sustainable finance, in addition to adhering to the traditional principles of due diligence, must also look at a broader perspective, and take into account the wider economic impact of social and environmental activities. Sustainable financing is intended for sustainable and environmentally friendly investments. “We are talking about the green and digital transition the first major transformation of the economy since the industrial revolution. The transition brings both opportunities and challenges for companies; it will be a dynamic process with substantial changes for both technology and value chains. Banks will be partners with companies involved in this process because banks can only succeed if businesses succeed, as it is a symbiotic relationship. For banks to provide financing, they will need to have adequate information and perform appropriate due diligence on the overall impact that the companies will have on the environment and society as well as how sustainability risks will affect companies.”

The central pillar of sustainable finance is taxonomy

The basis of sustainable finance in the EU is taxonomy, i.e. a classification system of environmentally sustainable economic activities. It acts as a reference point that defines when specific economic activities are environmentally sustainable and when they are not. The other two pillars of the EU sustainable finance framework are the rules governing sustainability information disclosures and sustainability tools for measurement and comparison.

Environmentally sustainable activities are those that significantly contribute to at least one of the six environmental sustainability goals, defined in the Taxonomy Regulations. Non-financial companies bound by the CSRD (Corporate Sustainability Reporting Directive) are obliged to report on at least three key performance indicators (KPIs) on compliance in relation to the taxonomy regulations, namely – turnover, capex and opex KPIs. Financial enterprises, including banks, will have their own KPIs with respect to the taxonomy criteria.

A basic use of the taxonomy is to review the compliance of a company’s existing operations with respect to the taxonomy criteria, while an advanced use of the taxonomy is applied when working with a bank on the green transition. An example of such advanced use of taxonomy could include:

- Assessing the degree of non-compliance of the company’s operations with respect to taxonomy criteria

- Developing a strategy and setting measurable goals to achieve compliance with the regulations

- Obtaining green financing to implement the strategy in agreement with the bank

In this way, the taxonomy can bring about a triple benefit – not only to the company itself, by increasing its competitiveness, but also to the bank by increasing the long-term sustainability of its portfolio and also to the government by supporting country level green transition objectives.

Green transition as an opportunity

In conclusion, Rant said that orientation towards sustainability and climate neutrality is imminent. It is also a long-term answer to the current energy crisis. There is no option for plan B because there is no other planet. The EU has developed a regulatory framework for sustainable finance as part of the broader strategy of the European Green Deal.

Taxonomy is a central pillar of sustainable finance in the EU, but at present, SMEs are not yet obliged to report on their compliance to the taxonomy, but they can benefit from using the taxonomy in cooperation with a bank. The main benefits provided are improvement of competitive position, easier access to financing and a timely management of physical, transitory and regulatory risks. At NLB they follow the taxonomy “When monitoring a company we are interested in how sustainable the business model is. This question is relevant to every company,” says Matjaž Rupnik, Director of Evaluation and Control at NLB. “We are trying to create a more sustainable portfolio”, adds Andrej Meža, Director of SME Business. “We think this is where we can make the biggest impact. We are looking at the whole region. For us, this is also an investment, and in the long run – a relief. We have started earlier than others because we have foreign owners, of which EBRD is one of the largest, and therefore we have certain standards to maintain. If you have sustainable investors, they will support you – the green transition will be a huge opportunity for all of us.”

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.

Green Credentials, skilled Workforce and Innovative Mindset make Slovenia a desirable Business Destination

Green, creative, smart

editor

Špela Bizjak

JOURNALIST AT THE ADRIATIC

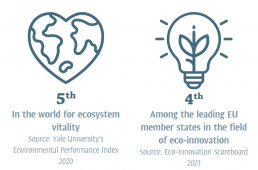

Slovenia has become one of the most open and export oriented economies in Europe, spanning biotechnology and mobility, home construction and energy. Its myriad of companies offer unique, high-value-added solutions that put Slovenia on the world map and inspire new generations of entrepreneurs to unlock their potential.

Discover Slovenia’s green, creative and smart competitive advantages and seize its favourable working environment for your own business endeavours.

GREEN.

With sustainability at its heart, it doesn’t come as a surprise that Slovenia’s environmental committment plays a fundamental role in its drive to promote green technology, corporate social responsibility and a culture of transparency. One of the companies working towards a greener future is Aquafil. Aquafil produces a groundbreaking nylon alternative derived from waste products such as ghost nets, rugs and carpets. Denis Jahić Managing Director at AquafilSLO, says Slovenia’s green credentials and skilled workforce make the country an obvious choice for the company’s operations.

Many investors are already tapping into Slovenia’s inherent advantages – its natural riches, a favourable geostrategic position, backing from strong research institutions and technology parks, business accelerators and, above all, an informed and motivated population.

CREATIVE.

Slovenia’s economy is thriving. The country has become an attractive place for investment and cross-border trade, with its highly skilled talent pool undoubtedly constituting the backbone of the country’s business development.

Attributing much of its success to first-rate talent is the heating solutions firm KRONOTERM. Bogdan Kronovšek, the company’s Co-owner and Managing Director, lists an excellent geographical position in Europe, good infrastructure, a quality education system and the government support as what has enabled the heat pump producer to scale to new heights of success. The hard-working, innovative, technically as well as linguistically skilled employees contribute to KRONOTERM’s goal to increase the number of people with access to modern, energy-saving and environmentally-friendly heating. The entire region can learn a lot from KRONOTERM, which has been named one of the 19 companies leading Europe’s heating sector out of fossil fuels with their breakthrough heat pump technology.

Dušan Olaj, the Founder and General Manager of Duol, agrees that Slovenia’s talent pool is essential for success: “Slovenia’s focus-oriented and free education system allows companies to choose from a diverse pool of professions and skills. Cooperation between universities and industry allows for a wide range of student grants, supporting the correct level of education of your future employees.” Duol, world-renowned for designing, manufacturing and installing inflatable halls, is one of the many Slovenian companies that push the boundaries and empower other entrepreneurs and corporates alike to take on ambitious projects that require technological know how themselves. Central to supporting entrepreneurship, internationalisation, foreign investment and technology is SPIRIT Slovenia Business Development Agency that remains available for any enquiries your business may have.

SMART.

The challenge of providing Europe and the wider world with energy security is as pressing as ever and it is reassuring to know that Slovenia possesses a range of innovative businesses that play a vital role in achieving the green energy transition.

And what makes Slovenia a competitive place to do business? Uroš Salobir, Director of the Strategic Innovation Department at ELES (operator of Slovenia’s electric power transmission network), believes it is the strong support from the government, industry and, in particular, the citizens. »Employees are future-oriented and the culture is characterised by adaptation to change.«

Boris Šajnović, Head of Project Management Office at Iskra – is another Slovenian company working towards green goals within the sustainable transportation sector, and it finds the country »a truly good pilot environment to test and demonstrate innovative projects with the full support of local people, government and positive business climate.« He adds the environment for innovation is supportive, strict intellectual property laws are in place and there is a good network of public agencies that help businesses at every stage of growth.

Between 2019 and 2020, the country’s patent application to the European Patent Office increased by 35% – the third highest in Europe.

Slovenia has 4200 researchers per 1 million people.

Business and investors looking for new opportunities are invited to get in touch with SPIRIT Slovenia Business Development Agency which offers strategic advice and operational support. The Agency provides practical information and advice on various business opportunities such as individual investment locations, Slovenian suppliers, specific industries and markets.

Find out more about doing business in Slovenia at www.Sloveniabusiness.eu.

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.