Powering the future

Europe has been given a Reason to accelerate Focus on Renewable Sources

Uroš Urbas

JOURNALIST

The Ukrainian war has caused energy crisis in Europe, however the European sentiment on the transition to renewables and Europe's self-sufficient energy supply look promising, so we can expect even more subsidies for hydrogen technologies.

The Ukrainian war has caused energy crisis in Europe, however the European sentiment on the transition to renewables and Europe's self-sufficient energy supply look promising, so we can expect even more subsidies for hydrogen technologies.

2023 will be a difficult year in the energy sector due to the Ukrainian crisis and the reduction in the supply of Russian gas, which Europe will replace with more expensive liquified gas from Africa, Arab countries and the United States of America, says Jože Bajuk, board member of the Slovenian energy company, Petrol. We can expect unprecedently high energy prices. However, there are positive expectations the European Commission will use mechanisms to prevent extreme price jumps. “I think Slovenia made a mistake a decade ago in preventing the construction of a gas terminal in Žavlje, nonetheless we are part of the EU that defines the development of the Energy Union and advocates diversified energy sources and energy independence,” Bajuk notes. “The EU will continue its independence from Russian energy sources, and Europe’s share of the consumption of Russian energy will decrease. Anyone with an alternative at home can be more self-sufficient.”

A spanish company wanted to build a terminal in Žavlje, just near Milje, but Slovenia, at the initiative of environmental organisations, managed to block this initiative in parliament. Thus, in 2009 a resolution on the protection of the Northern Adriatic (Resolution on the Adriatic Strategy) was adopted, prohibiting the construction of a gas terminal in the northern Adriatic.

Where are the gas terminals in the Adriatic?

Where are the gas terminals in the Adriatic?

Natural gas pumped by gas-rich countries such as Saudi Arabia, Iran, Algeria and Libya must first be liquefied, then loaded onto specially modified ships and transported to a floating LNG terminal. From here, it is distributed in the same form, and transported by road or distributed by pipeline.

Croatia will have three gas terminals in a few years: the largest gas terminal is in Omišalj on Krk, another gas terminal is in the port of Ploče and a permit has already been granted for the construction of a gas terminal in the Port of Gaženica in Zadar. The investment in the LNG terminal in Omišalj on Krk amounted to around EUR 360 million, of which EUR 102 million was granted by the EU. The original 2.6 billion cubic metres of natural gas capacity per year has already been increased to 2.9 billion cubic metres by technical adjustments to increase capacity to 3.5 billion cubic metres without additional harm to the environment. By comparison, Slovenia needs one billion cubic metres of gas for households and industry per year. Italy has three gas terminals, with one relevant for Slovenia, situated 15 kilometres off the coast of Porto Levante and Porto Viro near Rovigo. Its yearly capacity is 8 billion cubic metres of gas, which is one-tenth of Italy’s annual consumption. Albania is considering building a gas terminal (LNG).

The year 2023 and the energy crisis.

The year 2023 and the energy crisis.

In 2023, Bajuk foresees two key challenges in the energy field: The first is due to the December embargo on crude oil imports from Russia and the February embargo on imports of petroleum products from Russia. This will lead to a reduction in quantities and a consequent price increase. The second challenge is the possible recession in several European countries. The recession would lead to a reduction in demand for oil and petroleum products and, consequently, a downward trajectory of price.

These are, however, short-term challenges in the new year. “If we want to have inadequate natural gas reserves this winter, the challenge for the entire European energy sector and consequently for consumers remains the coming winter, both in terms of supply and price.”

Dilemma: Continue and/or change energy strategy?

Dilemma: Continue and/or change energy strategy?

For decades, Europe has seen the use of gas as the transition from the use of fossil fuels to renewable sourcing. This was the European response to the climate change dilemma. Environmentally, gas is more ecological, as it causes half as many CO2 emissions as coal. Europe, therefore, leaned towards gas, and the main supplier of cheap gas was Russia. At the same time, Germany in particular has been moving away from the use of nuclear energy and coal.

Before the war in Ukraine, Europe used 156 billion cubic metres of gas from Russia per year. Most of it came to Europe via North Stream 1, the infrastructure that Russia built over the decades for European consumption of its cheap gas. This created symbiosis: Europe built a gas-powered industry, and Russia built the infrastructure through which it sold its gas to Europe.

Is it likely that the EU could even increase the use of fossil fuels as a result of the energy crisis, or would it try to reach an agreement with Russia on the further supply of natural gas and oil? “I don’t think so. The EU does not have its own sources of oil, gas and coal on which it can rely in the long term, so renewable sourcing is the only sustainable option. These are water, sun and wind, and at least for some time nuclear energy, which is a very advanced technology and is, therefore, more secure. I expect the EU to focus even more on the direction of electricity. Later, hydrogen will take its position as an energy product, replacing oil and petroleum products. We had already eliminated coal before the Ukrainian crisis and its consumption will not increase significantly,” Bajuk estimates. The interviewee believes that the European strategy was not geared towards nuclear power plants, as newer and safer technology co-exists in parallel with renewable sources, it will be phased out of use on the principle that the dirtiest ones fall out first.

Bajuk believes that the Ukraine crisis has pointed the European energy strategy towards independence and clean renewables, which have not yet been entrenched, have probably been strengthened. It also cites a political argument: Putin challenged the EU, saying you wanted energy independence, look what you got – the energy crisis! The EU’s answer to this was: Let’s go all the way! We’re going to disconnect from Russian sources, and we’re going to put an embargo on Russian oil and gas. “Such a response is a real “booster” for renewable sources, so the transition will happen even faster than it would otherwise.” However, the effects of renewable sources will only appear over the next one or two decades, and in the meantime, the EU will be more dependent on LNG, which will be more expensive than Russian gas. At the same time, the EU will dedicate even more money to hydrogen technologies. Hopes are high for Hydrogen as a medium for energy transfer or as an energy source equivalent to renewable sources but used mainly in industrial centres. “Subsidies in solar and wind energy were also very expensive, today they allow less than 40 euros per megawatt hours of electricity because of the enviably low cost of clean energy, Bajuk says.

“I think the EU will use the current energy crisis primarily to accelerate Europe’s independence from Russia and, at the same time, to make an even bigger transition to renewables.” – Jože Bajuk

Plans in the region.

Plans in the region.

Petrol plans to invest in the construction of renewable sources only in Slovenia and Croatia. In Serbia, it will mainly develop its supply of petroleum products. The reason for this are primarily regulatory. “The life span of a wind farm is 25 to 30 years, so the investor must have a stable regulatory environment in the country, which the EU provides. In non-EU countries, the regulatory risk is too high. Even if, for example, BiH, especially in Herzegovina, has enormous potential for such investments in renewable power plants, the political and legal risks are too great,” Bajuk believes.

He also points out that profit margins are high and that the renewable production facility is an attractive business opportunity for investors with relatively short reimbursement periods. Thus, starting in 2023 Petrol will launch a 22-megawatt solar power plant in Croatia, which will have an annual production of 29 gigawatts. The investment amounts to EUR 17 million. A 30-megawatt wind farm is planned in Croatia by 2025.

As the EU will further promote self-sufficiency, the impact of newly built buildings will be measured over a decade. Bajuk describes the different approaches taken by Slovenia and Croatia over the last decade: The Croats built 1400 megawatts of wind farms in 10 years. In the same period, Slovenia built 1100 megawatts of hydropower plants, which have higher energy efficiency.

Croatia plans to create the potential for an additional 3000 megawatt hours of electricity production with additional wind power plants for 1000 megawatts and increasing the power of the grid. The 10-year-old Croatian plan is to build a network that would provide about 5000 megawatts of electricity. Another difference is the completely different priorities of these countries over the last decade. Slovenia is only now in the process of intensive corrections to environmental legislatiton that will make it easier to build large facilities for renewable sources. At the same time, it is far ahead of Croatia in the self-sufficiency of households and businesses, as Slovenia has been installing solar power plants intensively in recent years.

What will the future of mobility look like?

What will the future of mobility look like?

The jump in the sales of electric cars didn’t happen. Therefore, in Bajuk’s view, cars with internal combustion motors or oil-powered vehicles will continue to play a prominent role in the automotive industry for at least 30 years. “The European assessment of how quickly electric cars will replace internal combustion cars was much more optimistic as statistics show that the forecast was about 30% higher than the actual transition each year. This means there is exponential growth in the failure to achieve the electricity transition forecast, cumulatively over the years,” Bajuk explains.

The car industry has made a clear commitment to prioritize electric cars over internal combustion cars. Huge investments are aimed primarily at the development of electric cars. However, if the entire existing fleet were to be replaced, that is, old cars with internal combustion replaced with new electric ones, the cycle for complete replacement would take 20 years, Bajuk believes. He also reveals his personal preference: he replaced his car with a connecting hybrid with an electric one in December. Reason: The infrastructure from home to work is so developed that it does not cause any problems.

In the interviewee’s view, Petrol has a good starting point to replace conventional drives with alternative energy products and the provision of services and maintenance. For the future, however, he believes: “There won’t be a single winning energy. Electricity will not completely replace petroleum products.” He is convinced that the use of energy products will be diversified. For example, diesel for working machines in the forest or fields, electric cars in the city and hydrogen will almost certainly play an important role in mobility.

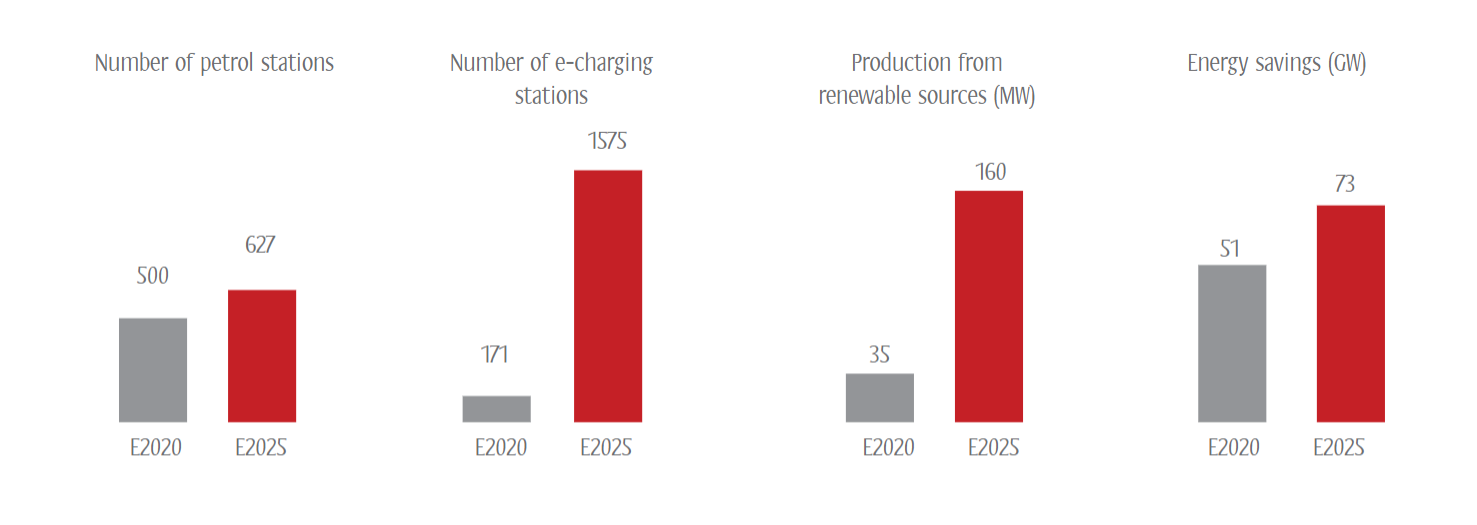

Total number of service statins at the end of 2025 in all markets: 627.

Charging infrastructure for electric vehicles at the end of 2025: 1575 charging points.

Forecast by Slovenian energy company Petrol: At the end of 2025, production from renewable energy sources will reach 160 MW of electricity. That’s 78% more than in 2020. Energy renovation projects will achieve 73 GW of energy savings for end users.

THE ADRIATIC

This article was originally published in The Adriatic Journal: Strategic Foresight 2023.

If you want a copy, please contact us at info@adriaticjournal.com.